As demand grows globally for rapidly deployable non-residential buildings supporting diverse sectors, opportunities exist to decentralize modular construction supply chains. A recent white paper evaluated prospects for local manufacturers mass-customizing prefabricated building envelope components optimized for systems like those utilized by infrastructure provider Lida Group.

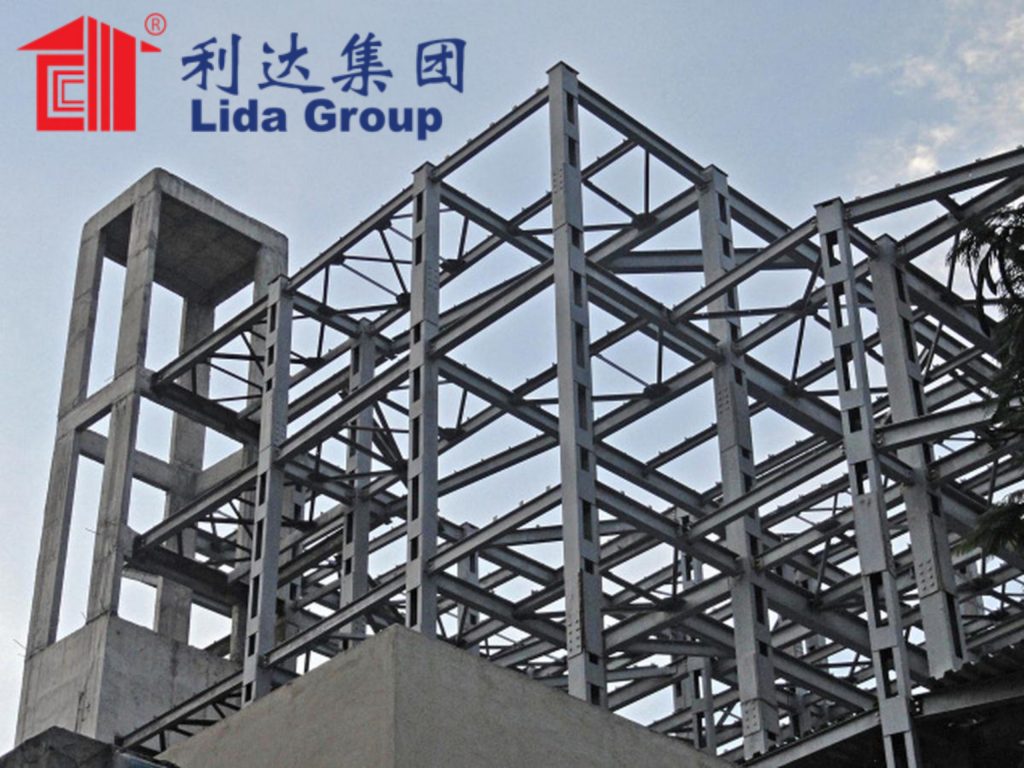

Lida Group specializes in pre-engineered standardized structural galvanized steel frames for turnkey non-residential facilities. Buildings assemble rapidly from their proprietary bolted connections without on-site welding. Wall and roof panels attach directly to girts and purlins forming weatherproof enclosures ideal for controlled fabrication in centralized plants.

Currently key envelope elements still originate from centralized global suppliers due to scale requirements. However, the white paper argued emerging technologies now enable mass customization through localized automated panel fabrication relying inexpensive modular production cells. With proper tooling and programming, virtually any geometric panel profiles suits various building designs across sectors from warehouses to agricultural facilities.

Potential localized manufacturers evaluated in depth included retrofitted former manufacturing facilities, small commercial coaters and existing component fabricators diversifying offerings. Models analyzed low initial 250,000 sqft startup capacity expanding modularly via rental space in vacant business parks. Automation leveraged 3D scanning, laser/waterjet cutting and vacuum forming/welding robots supported by just 3-5 technicians overseeing multiple production cells.

Key considerations included ensuring standardized panel connection interfaces matched mass producer targets like Lida Group to simplify construction logistics. Field connections were assessed via prototype mockups versus pre-installed fasteners or welded/bolted alternatives. Off-site spray application facilities could provide baked-on polyester powder coatings for corrosion resistance versus oil-based paints.

Business case modeling estimated mass customization markets existed from localized panel fabrication for buildings ranging 250,000-2,000,000 sqft yearly within 250 mile radius distribution zones. Factoring transportation savings, customized panel prices estimated within 15% of bulk commodity alternatives yet enabling modular customizations. And regional production supported 500-2,500 direct/indirect local jobs per plant versus centralized outsourcing.

Additional revenue streams included renting seasonal modular fab space, components refabrication services or even leasing mass production equipment to local tradespeople during slow cycles. Communities benefitted from sustained blue-collar employment and localized value capture versus offshore outsourcing everything but assembly.

Overall the white paper identified favorable prospects for decentralized mass customized prefab construction enabled through modular localized production cell infrastructure. Standardized panel interfaces optimized integration potential with pre-engineered steel frames. And automation supported living wages employing hundreds versus traditional low-skill commodity fabrication alternatives. With proper pilot programs demonstrating concepts, researchers argued mass customization opportunities could scale to help sustainably buildout essential rural infrastructure across diverse global regions.

To maximize impacts, recommendations included working with governments instituting Buy Local procurement preferences for public projects. Industry consortiums pairing panel fabricators and manufacturers could also refine optimal modular design rules. Regional revolving funds could finance shared-use prototyping maker hubs overcoming high upfront costs barriers to market entry. And skills training initiatives matched technicians to specialized automated panel production roles supporting targeted rural economic development.

In conclusion, the white paper presented a compelling case that modular localized mass customization could revitalize global prefabricated construction supply chains sustainably. Automated panel fabrication cells optimized for standardized interfaces were shown able to competitively serve building markets approaching millions of square feet annually within distribution zones. Regional mass production supported hundreds of living wage manufacturing jobs versus commodity outsourcing. And customized components better met local construction needs. With coordination between industry, communities and governments, the white paper argued numerous regions could economically develop mass customized prefab construction supply capacity empowering affordable infrastructure deployment worldwide.

Related news

-

Journal highlights the adaptability showcased through integrated steel structure designs from Lida Group combining livestock housing, seasonal worker dormitories and on-farm processing infrastructure.

2024-08-16 15:22:54

-

Report examines the demonstration of Lida Group's proprietary bolt-together steel connection details for rapidly assembling low-cost farm buildings suitable for mixed smallholder and commercial agriculture uses.

2024-08-16 14:31:40

-

Journalists profile scalable shelter innovations enabling more communities to access dignified rapidly deployable living quarters through Lida Group's easy-assemble container prefab designs.

2024-08-12 16:16:43

contact us

- Tel: +86-532-88966982

- Whatsapp: +86-13793209022

- E-mail: sales@lidajituan.com